Though you weren’t able to find it on television, the debut of a controversial new professional golf league represented arguably the most intriguing story in sports from last weekend.

LIV Golf is a Saudi Arabian-funded tour consisting of eight events across the world. Its inaugural event, the LIV Golf Invitational in London, ended Saturday with South African Charl Schwartzel emerging as the $4 million winner. The three-round tournament could only be seen on YouTube, but coverage of it could be found on most national and international media outlets.

It’s a big deal when an American establishment is challenged like this.

The Professional Golfers’ Association Tour, formed in 1929, has never faced this kind of threat. PGA events, packed with the world’s best golfers, have long been the staple of the sport.

LIV (a reference to the Roman numerals for the number 54, a nod to the number of holes in the upstart tour’s tournaments) is trying to position itself as a PGA adversary by poaching big-name players such as Phil Mickelson, Dustin Johnson and Sergio Garcia for its first event. It has since gained commitments from past major championship winners Patrick Reed and Bryson DeChambeau. The league is pulling them in with eye-popping contracts of up to $200 million.

By comparison, Tiger Woods has earned $121 million in career prize money, according to the PGA.

(The PGA quickly suspended its 17 members who participated in the LIV Golf International.)

The backdrop to all of this, of course, is that LIV is backed by Saudi Arabia's Public Investment Fund. The country’s crown prince, Mohammed bin Salman, chairs the fund. A U.S. intelligence report named bin Salman responsible for ordering the assassination of journalist Jamal Khashoggi in 2018, an action bin Salman has denied.

The Khashoggi murder is in line with several human-rights violations alleged to be taking place in Saudi Arabia.

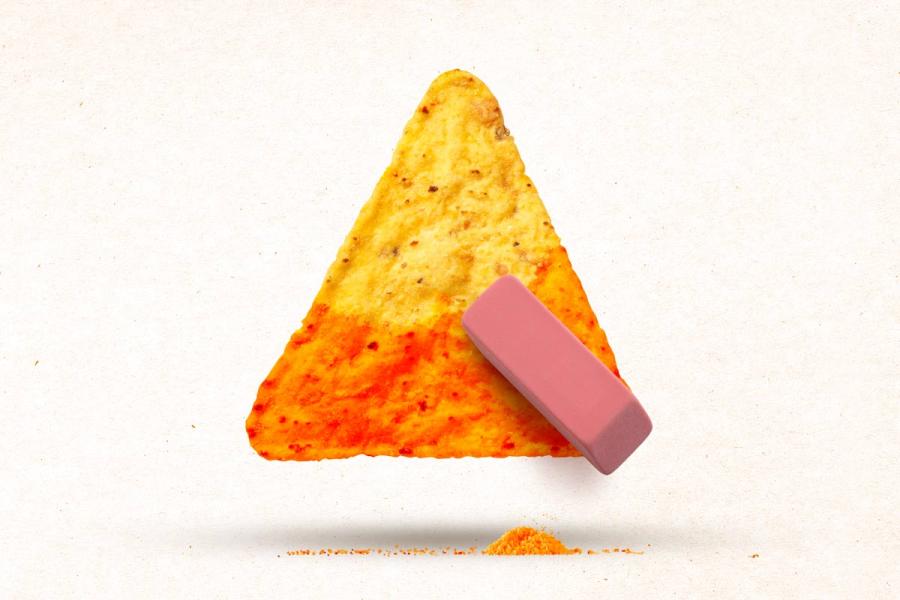

Critics have suggested that the Saudis’ backing the LIV tour is a clear-cut example of “sportswashing,” or using a positive association with sports to draw attention away from notorious behavior. Other examples include China’s hosting of the Winter Olympics and Qatar hosting the World Cup soccer tournament.

Being linked to this kind of lightning rod can certainly be a risk for a player’s brand, said Kim Whitler, an associate professor at the University of Virginia’s Darden School of Business.