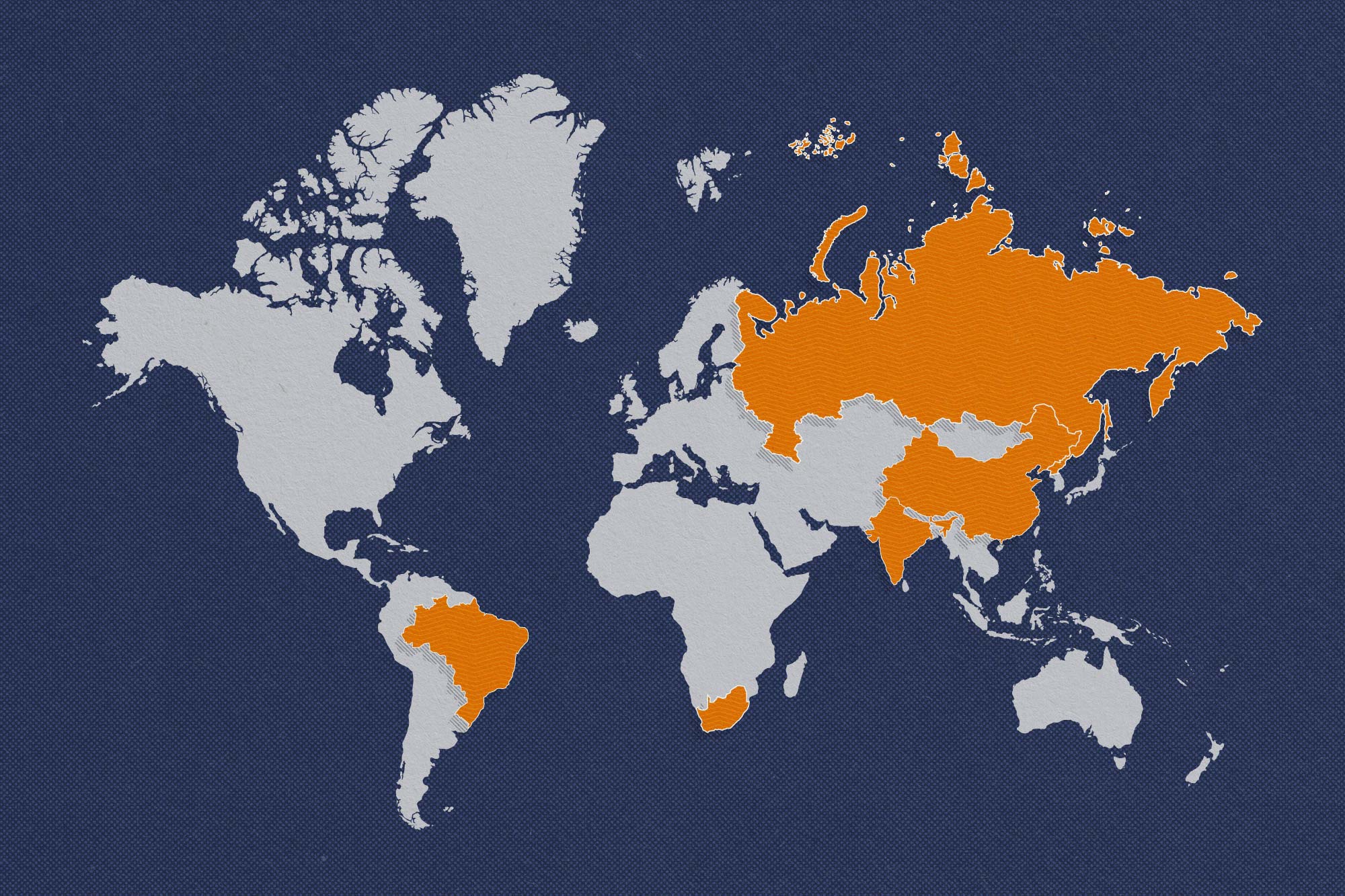

A group of nations known as “BRICS” – Brazil, Russia, India, China and South Africa – advertise themselves as an alternative to Western alliances, but a University of Virginia scholar does not see them as much of a rival to the United States.

BRICS held a summit recently in South Africa to discuss the BRICS Development Bank and expand its membership. That doesn’t overly concern Philip Potter, a professor of politics and public policy and the founding director of the National Security Policy Center at the Frank Batten School of Leadership and Public Policy.

UVA Today asked Potter about BRICS and why the U.S. shouldn’t worry.

Q. What is it about BRICS that makes them less of a threat?

A. I take a fairly dim view of BRICS as an effective political entity. These countries don’t have a lot in common other than that they are big and opposed to the United States. Russia and China supposedly enjoy a “friendship without limits," but really view one another suspiciously. India has dicey relations with China, at best. Brazil is in the wrong hemisphere and has relatively few overlapping interests. South Africa was added for symmetry to make this a Global South story, a Global South response to the G7. But when you look at the membership of the G7, these are countries that cooperate on many dimensions and are in strategic alliances with one another. They train together militarily; they operate in the same global economy.

Q. What is it that brings the BRICS countries together?

A. Opposition to the United States. And that’s the problem. They all know they’re against a U.S.-dominated global order.

As to what they’re for, there are comparatively fewer aligned interests. It’s challenging for them to put forward an alternative because that’s when their divergent interests start coming to the fore.

Q. How did the recent summit in South Africa fare?

A. My understanding is that they were not able to reach deep agreements with regard to currency and broader cooperation. They added several countries to the block that don’t fundamentally change the equation. Argentina has longstanding economic and political challenges. Egypt is chronically mismanaged. Ethiopia recently suffered a civil war and remains challenged. Iran is Iran. Saudi Arabia is a serious player with meaningful resources, but it plays both sides with interests that sometimes align with the West and sometimes with countries like China and Russia.

To my mind, the Gulf states signing up was the most interesting thing that came out of that summit to me. That said, I didn’t find it terribly surprising that Saudi Arabia and the United Arab Emirates were willing to sign on, at least in principle.

Q. What is the BRICS Development Bank and what does it do?

A. It was supposed to be an answer to the International Monetary Fund and the World Bank, a global lender that would help to invest in growth, bail out economies, reduce instability, that sort of thing. China and Russia offered to throw a bunch of money into the IMF in return for changing the voting rules and making it less Western-dominated. That did not work out and the New Development Bank was the next-best thing.

They put a considerable amount of money behind the BRICS Development Bank, at least in principle, and then had a series of false starts. The participants struggled to agree on who was going to put in what, how it would be controlled, what its objectives would be. This is part of the same, larger stories. It’s comparatively easy for a bloc of countries to coalesce on what they don’t like, but as soon as it comes around to putting something concrete in its place, they run aground on the reality of their divergent capabilities and interests

Q. Periodically, there is talk about the BRICS countries coming up with a currency. Where does that stand?

A. In my view, it’s a total non-starter.

What they’re against is dollar hegemony, the ability of the U.S. to weaponize the financial system, and impose sanctions on them or other people. The U.S. derives tremendous benefit from the dollar and the financial system in terms of global power. It’s not surprising that BRICS countries would like to contest that.

Lots of countries around the world see U.S. financial dominance as problematic. They appreciate when China and Russia push back against it. What to do about that is a totally different question, because then you have to come up with the replacement.

For China, far better than a BRICS currency would be if they could make the Renminbi a global currency, a counterweight that would give them power rather than BRICS. But they can’t do it because the global markets don’t trust them fully. So the dollar remains a global store of value and mechanism of exchange.

Q. What does this mean to the U.S.?

A. It means there are a lot of countries out there that resent the place we hold in the world. I think that’s important to keep sight of. It’s also worth remembering that we were about a quarter of the global GDP in 1980 and are about a quarter of the global GDP right now. We’ve successfully hung on for a long time. Personally, I think it is easy for us to take for granted because we’re so accustomed to it.

We forget how much benefit we get out of these positions that we’ve generated for ourselves. I think Americans often ask why are we paying to police the global system? Why are we the lender of last resort? Why are we bailing so and so out? The answer is because we then get to own, or at least hold a primary stake in, the whole system that we then use to extend our political power, our security and our economy.

And it’s hard to see that because there’s been no alternative in anyone’s lifetime. It’s how it’s always been and I think it can be really easy for voters to give up on. Our adversaries would love nothing more. I think people should pause because the position we hold in the global system is valuable and worth investing in and hanging on to.

I don’t think BRICS is going to mess this up for us, but we could mess it up for ourselves.

Media Contact

University News Associate Office of University Communications

mkelly@virginia.edu (434) 924-7291

Article Information

October 19, 2025