May 6, 2010 — Is it possible to design a global investment portfolio that provides double-digit returns while alleviating poverty?

A team of four University of Virginia students did just that in the course of winning Cornell University's annual SustaInvest competition, held April 16 in Ithaca, N.Y.

The team of first- and second-year students from U.Va.'s College of Arts & Sciences beat out teams of graduate students from several elite business schools, including Dartmouth University's Tuck School of Business, New York University's Stern School of Business and Cornell's Johnson School.

Sponsored by the Center for Sustainable Global Enterprise at Cornell, the SustaInvest portfolio pitch competition challenges students to propose and defend a sustainable investment strategy that addresses environmental and social problems using a hypothetical $10 million from the Cornell endowment. Based on the submission of a portfolio pitch book, five teams were chosen to compete for a $1,000 prize in the competition's final round.

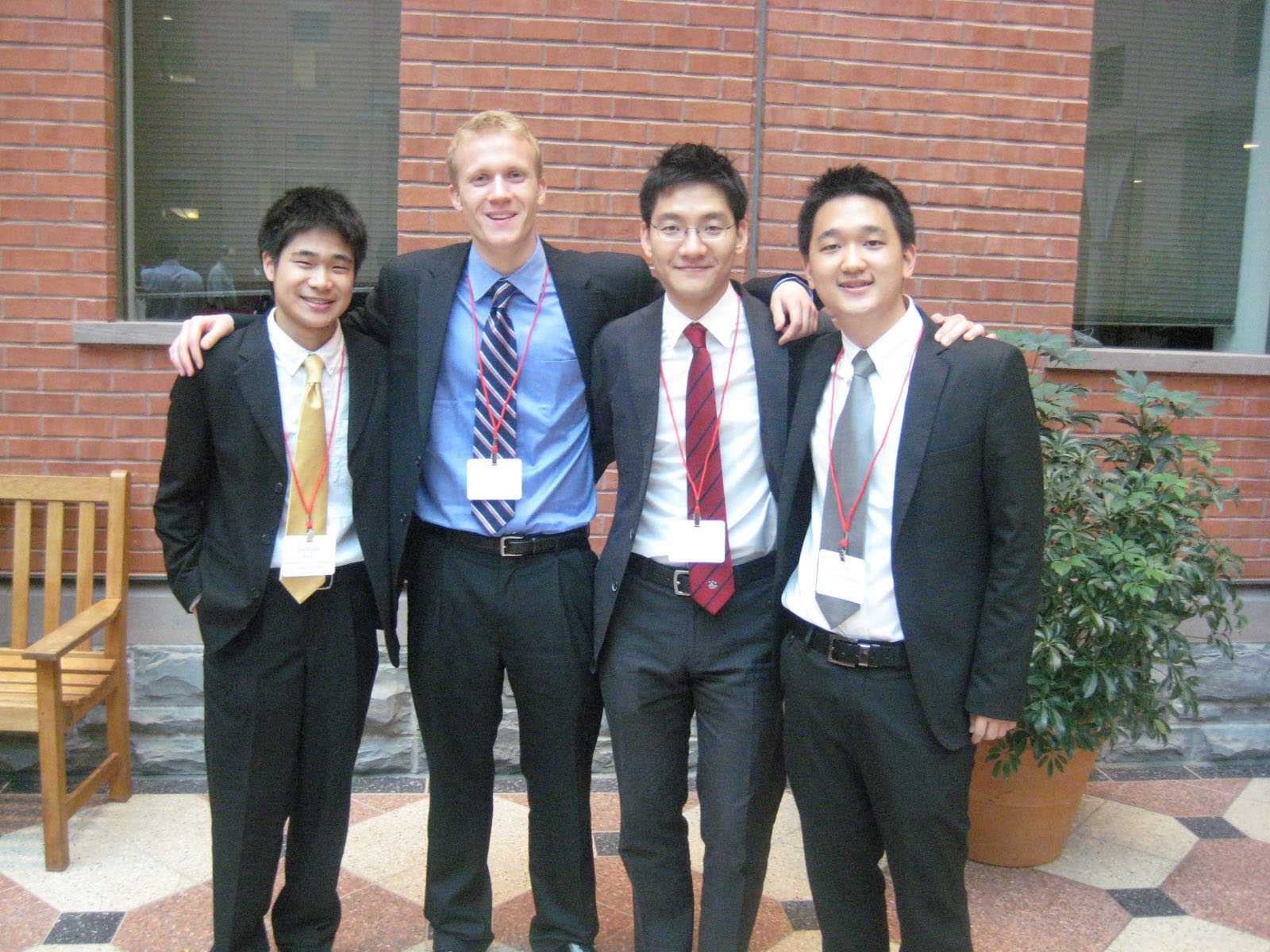

The U.Va. team of first-year student Christopher Rannefors and second-years Nicholas Kaw, Yongjin Lee and Siravut Thammavaranucupt — all of whom hope to transfer into the McIntire School of Commerce — designed a poverty-fighting portfolio of investments using a different approach than their competitors, Lee said.

"At the beginning, we picked poverty as the issue we were going to address, and made it clear why poverty is an important issue," he said. "That led to our investment strategy, because it helped us pick the industries, and ultimately the companies, we were going to invest in."

Poverty is defined by the United Nations as a severe lack of primary human needs, including basic housing, clean water, healthy living environments, affordable communication and financial opportunities, Rannefors explained. So the team chose to invest in four industries that cater to the world's underserved populations, that have significant growth potential and that are sustainable: microfinance, technology, telecommunications and sustainable real estate.

"We tried to keep our argument as simple as possible," Rannefors said. "Poverty means a certain set of issues, and we're going to address those issues by investing in sustainable businesses within a particular set of industries."

After identifying those industries, the team did extensive research to pick a portfolio of seven outstanding companies. "To lower risk without substantially lowering returns, we diversified across industries, asset classes and geographies," Lee said.

The team convincingly argued that their approach would produce long-term benefits, both social and economic. "We made the case that when poverty is alleviated, people who have been shut out by poverty will be able to participate in the market, gradually leading to emerging markets and ultimately to an increase in global growth," Lee said.

In contrast to their approach, Thammavaranucupt said, the other four finalist teams tended to focus more on strict financial and risk analytics, which proved difficult to defend in front of the competition's judges, a panel of seasoned investors that included Scott J. Budde, managing director of Global Social and Community Investing at TIAA-CREF; Matt Cohen, principal of City Light Capital; Gisele Everett, head of private equity investments for Deutsche Bank Climate Change Advisors; and Mark Milstein, director of Cornell's Center for Sustainable Global Enterprise.

The U.Va. team got plenty of preparation help from Marcia Pentz, a lecturer at McIntire who teaches management communication and public speaking. "Professor Pentz really showed us how to make our presentation engaging, conversational and interactive, in terms of both our language and body language," Rannefors said. "She was a huge help."

The team also received valuable mentoring, guidance and advice from McIntire students Peter Elbaor, Connor Fusselman and Sidhant Ganeriwalla, all of whom are current or former leaders of the McIntire-based Socially Responsible Investment Organization. Fusselman and Ganeriwalla shared lessons learned in last year's SustaInvest competition, where they earned a second-place finish.

"Working on this project has been an incredible experience," Rannefors said, reflecting on the scores of hours the team put into their SustaInvest experience. The group learned to work as a team, making the most of everyone's complementary strengths, said Lee. "We had a lot of fun with it, and we came out with very good friendships."

A team of four University of Virginia students did just that in the course of winning Cornell University's annual SustaInvest competition, held April 16 in Ithaca, N.Y.

The team of first- and second-year students from U.Va.'s College of Arts & Sciences beat out teams of graduate students from several elite business schools, including Dartmouth University's Tuck School of Business, New York University's Stern School of Business and Cornell's Johnson School.

Sponsored by the Center for Sustainable Global Enterprise at Cornell, the SustaInvest portfolio pitch competition challenges students to propose and defend a sustainable investment strategy that addresses environmental and social problems using a hypothetical $10 million from the Cornell endowment. Based on the submission of a portfolio pitch book, five teams were chosen to compete for a $1,000 prize in the competition's final round.

The U.Va. team of first-year student Christopher Rannefors and second-years Nicholas Kaw, Yongjin Lee and Siravut Thammavaranucupt — all of whom hope to transfer into the McIntire School of Commerce — designed a poverty-fighting portfolio of investments using a different approach than their competitors, Lee said.

"At the beginning, we picked poverty as the issue we were going to address, and made it clear why poverty is an important issue," he said. "That led to our investment strategy, because it helped us pick the industries, and ultimately the companies, we were going to invest in."

Poverty is defined by the United Nations as a severe lack of primary human needs, including basic housing, clean water, healthy living environments, affordable communication and financial opportunities, Rannefors explained. So the team chose to invest in four industries that cater to the world's underserved populations, that have significant growth potential and that are sustainable: microfinance, technology, telecommunications and sustainable real estate.

"We tried to keep our argument as simple as possible," Rannefors said. "Poverty means a certain set of issues, and we're going to address those issues by investing in sustainable businesses within a particular set of industries."

After identifying those industries, the team did extensive research to pick a portfolio of seven outstanding companies. "To lower risk without substantially lowering returns, we diversified across industries, asset classes and geographies," Lee said.

The team convincingly argued that their approach would produce long-term benefits, both social and economic. "We made the case that when poverty is alleviated, people who have been shut out by poverty will be able to participate in the market, gradually leading to emerging markets and ultimately to an increase in global growth," Lee said.

In contrast to their approach, Thammavaranucupt said, the other four finalist teams tended to focus more on strict financial and risk analytics, which proved difficult to defend in front of the competition's judges, a panel of seasoned investors that included Scott J. Budde, managing director of Global Social and Community Investing at TIAA-CREF; Matt Cohen, principal of City Light Capital; Gisele Everett, head of private equity investments for Deutsche Bank Climate Change Advisors; and Mark Milstein, director of Cornell's Center for Sustainable Global Enterprise.

The U.Va. team got plenty of preparation help from Marcia Pentz, a lecturer at McIntire who teaches management communication and public speaking. "Professor Pentz really showed us how to make our presentation engaging, conversational and interactive, in terms of both our language and body language," Rannefors said. "She was a huge help."

The team also received valuable mentoring, guidance and advice from McIntire students Peter Elbaor, Connor Fusselman and Sidhant Ganeriwalla, all of whom are current or former leaders of the McIntire-based Socially Responsible Investment Organization. Fusselman and Ganeriwalla shared lessons learned in last year's SustaInvest competition, where they earned a second-place finish.

"Working on this project has been an incredible experience," Rannefors said, reflecting on the scores of hours the team put into their SustaInvest experience. The group learned to work as a team, making the most of everyone's complementary strengths, said Lee. "We had a lot of fun with it, and we came out with very good friendships."

— By Mary Summers and Brevy Cannon

Media Contact

Article Information

May 6, 2010

/content/team-uva-undergraduates-wins-cornells-sustainvest-competition