After all, “Money is big. Health care is a business. We live in America.”

Financial literacy is a required part of every nursing school’s curriculum, but schools can decide for themselves just how to build students’ financial skills.

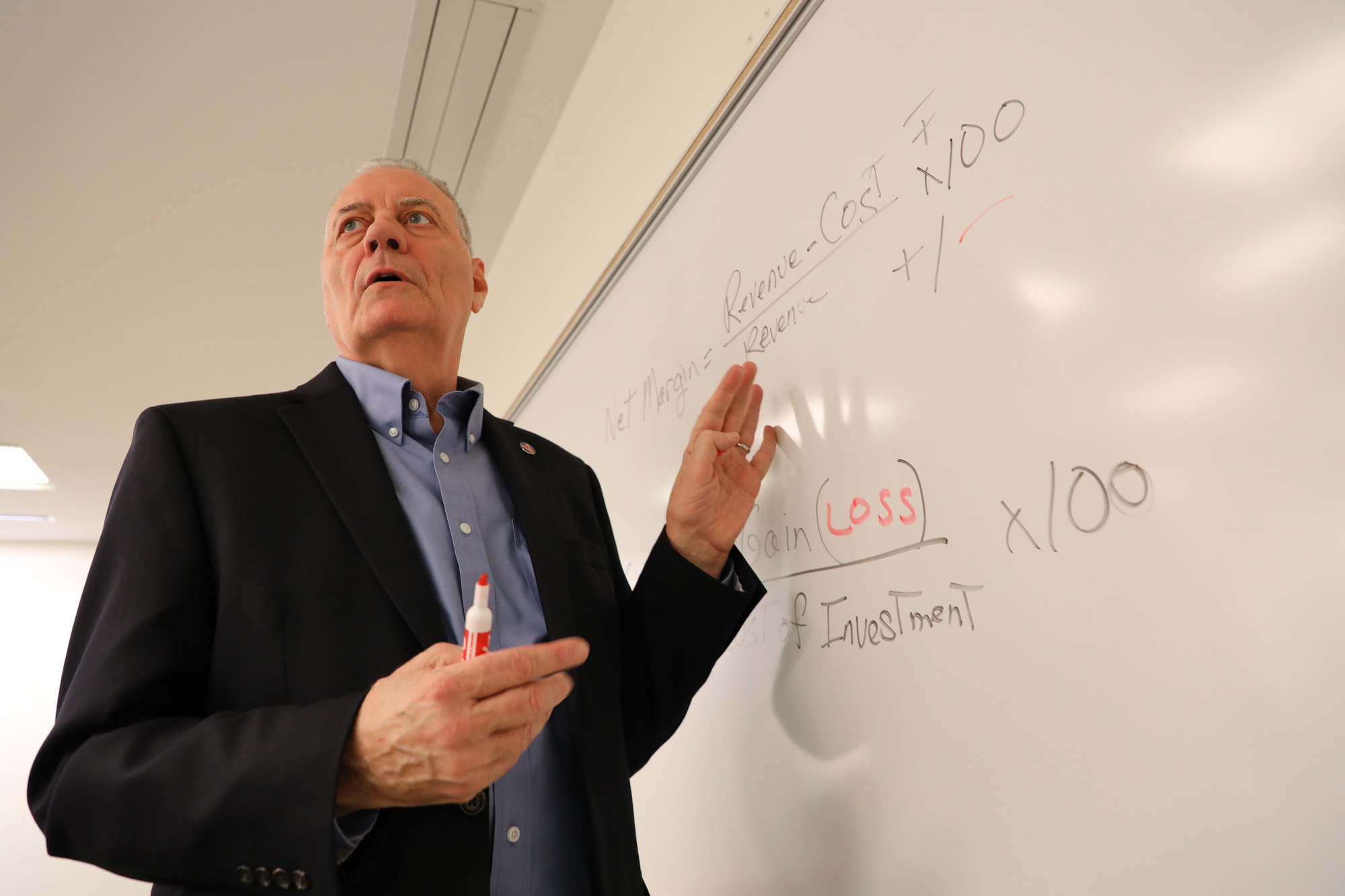

In Ridge’s courses, students don’t just get theoretical knowledge about a hospital’s resources; they get to practice navigating those systems. Those in the Doctor of Nursing Practice program dig into budgetary case studies; develop, refine and present two-minute executive pitches; and discuss stakeholder engagement. They bandy about terms typically only heard in business classes like “margins,” “value-based purchasing,” “bundling” and “cost savings versus cost reductions.”

Each student in the program completes a capstone presentation which demonstrates their growing financial facility – a shift from even just a year or two back, said Beth Quatrara, an assistant professor and director of the Doctor of Nursing Practice program.

Honing nurses’ money sense “hasn’t always been a natural part of graduate nursing education,” Quatrara said. “But if you want to be at the table and participate in a conversation about anything – a new procedure, piece of equipment, hiring a new staff member, developing a new type of clinic – you have to be nimble in the use of business language.”

For hospital administrators, being surrounded by nurses with financial know-how is a boon because they’re “like translators,” UVA Health nurse scientist Pamela DeGuzman explained.

DeGuzman, who attended nursing school before earning an MBA to develop money sense, said Ridge’s and Quatrara’s fiscal lessons arm nurses with the “credibility to understand care delivery and understand the numbers.”

“The more nurses have that, the more they will have a place in the conversation, because without an understanding and appreciation for what has to be a necessary conversation about money, they’re – we’re – not going to be taken seriously.”

For Claire Lewis, a student in the program, the learning’s been transformational in her work as a gynecological oncology nurse practitioner.

“I’ve learned how to initiate research. To understand leadership and financial models. To speak and be heard by people in the C-suite,” Lewis said.

Her capstone centered on the impact of the early introduction of palliative care for outpatients with gynecological cancers, which she projected would save nearly $500,00 in the first three years, an 86% return on investment. “Before, it was ‘fly by the seat of my pants’ and use my personality to hold court, but what I’ve learned has set a leadership foundation.”

Money skills also helped Doctor of Nursing Practice graduate Caitlyn Burchfield make a business case for the model of work she does at Virginia at Home, an in-home primary care pilot launched in 2020 for high-risk older adults. Before coming to Virginia at Home, Burchfield chafed at working in fee-for-service health systems that incentivized expensive tests and procedures and patient quotas. She said she’s learned to make convincing financial arguments for her employer’s brand of value-based care, which is far more in tune with her nursing ethos.

According to Burchfield’s projections, Virginia at Home could save the state nearly $18 million by year three. It costs $1 million to operate each year, meaning it could generate an 886% return on investment, not to mention the incredible positive effect on patients’ and families’ lives, since it reduces hospital readmissions by 80% and emergency room visits by almost half.

“It’s one thing to intuitively say, ‘This should save us money,’” Burchfield said. “But we’re learning to say it compellingly so other leaders can hear us and take us seriously.”