Inside the CIA, Bash said, there were analysts who supported a bomber strike.

However, Bash said that when his boss, former CIA Director Leon Panetta, heard exactly how pulverized the target would be, he said he couldn’t recommend the action to Obama.

“The B-2 option was, in some ways, cleaner. It would have absolutely killed everyone in the compound. There would be no risk to our own force,” Bash said. “But it would have eliminated the ability of the world to see evidence that bin Laden was there. All of the DNA and everything at that compound would have been pulverized to dust.

“… Ultimately, I think the president and Mr. Panetta realized that we needed to have the evidence that bin Laden was there.”

Bash said Obama also shot down another of the potential COAs, a joint operation with Pakistan. “He said, ‘We’re not going to tell Pakistan. So take that one off the table.’”

Bash says it eventually became clear that the heliborne assault was the way to go.

At the conclusion of the talk, a student asked Bash how potential negative consequences – such as bin Laden not actually being in the house – played into the decision-making process.

“That’s a nightmare,” Bash said.

“… I think you obviously would have seen a ton of criticism of Obama, congressional hearings, heads would have rolled … and I think the whole thrust of the counterterrorism fight would have been altered.

“But I’ve got to say, too, I was so confident – probably overly confident. I don’t think I was cocky about it, but I do remember going over and over it in my head, like, ‘Is there a chance we’re wrong?’ And every time I tried to wring it out, I just couldn’t find a real rational way that we were.”

Super Bowl XLIX

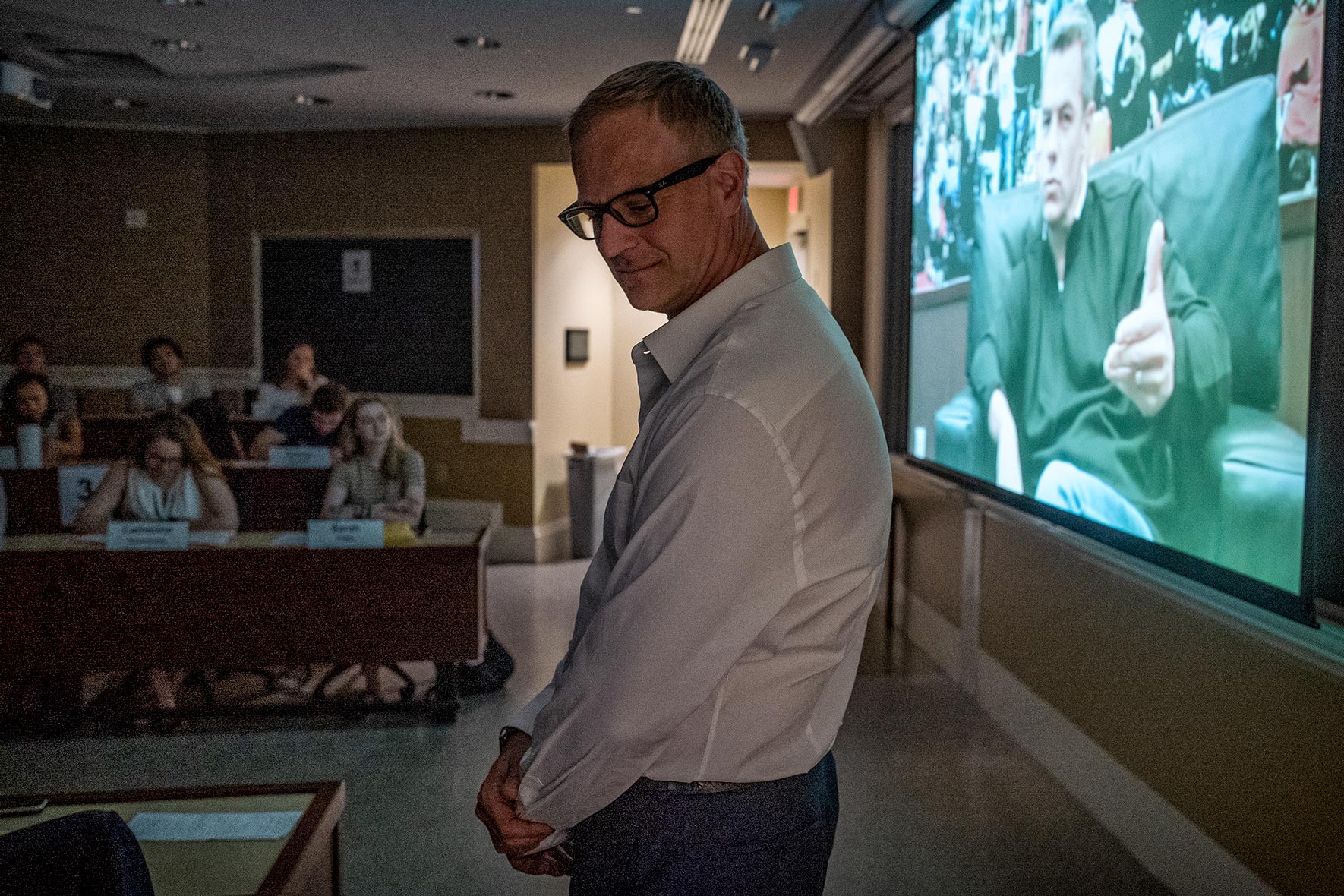

Before Mendenhall talked about the play call he regretted against Virginia Tech, he sat in the back of the classroom as Griffin and the students examined what is considered one of the most infamous play calls in Super Bowl history.

Trailing the New England Patriots by four points late in Super Bowl XLIX, the Seattle Seahawks had driven all the way down the field and were poised to take the lead.

On second down and goal at the Patriots’ 1-yard-line with 26 seconds remaining, Seattle head coach Pete Carroll – with most people expecting him to hand the ball off to star running back Marshawn Lynch – called instead for a Russell Wilson pass. It was intercepted, ensuring the Patriots’ victory.

NBC’s Chris Collinsworth immediately questioned the decision. Other commentators, like Hall-of-Fame cornerback Deion Sanders, followed suit. Twitter exploded as only Twitter can. The next day’s newspapers featured headlines such as, “Worst Play Call Ever.”

“Was this a bad decision?” Griffin asked the class.

“I think you have to step back from the outcome a little bit when you’re trying to evaluate the decision,” one student said.

Griffin nodded in agreement. “If you know the outcome, that will always color whether you think it was good or bad,” he said.

“Outcomes are important. We’re not here to change that. But when we go back in time, we have to be very careful not to let our emotions and our biases influence how we see decision-making.”